Blogpost 1 - The challenges in cash-flow forecasting in the construction industry

April 25th, 2024

While reliable cash-flow forecasts are essential for sound financial decisions in construction, the industry’s inherent characteristics make them notoriously challenging to predict.

Here’s why:

Constantly Shifting Project Timelines

Even the most meticulously planned schedules can be disrupted by unforeseen circumstances. Construction timelines are constantly in flux due to change orders, material shortages or subcontractors issues and weather caused delays.

Lengthy Payment Cycles

Cash-flow is further complicated by the often slow and unpredictable pace of payments. The terms of payment may widely vary from one project to another and lead to high prefinancing needs by the contractor. Potential disputes with the clients over deliverables or costs can further delay payments.

Fluctuating Costs

As mentioned earlier, change orders not only impact timelines but can also significantly increase project costs. Material price fluctuations can also significantly impact budgets.

Limited Historical Relevance

The unique nature of each construction project makes historical data a less reliable predictor of future cash-flow. No two projects are exactly alike, making it difficult to simply extrapolate past experiences to future endeavours.

Construction companies must therefore continually evaluate their cash-flow needs to best use their available funds.

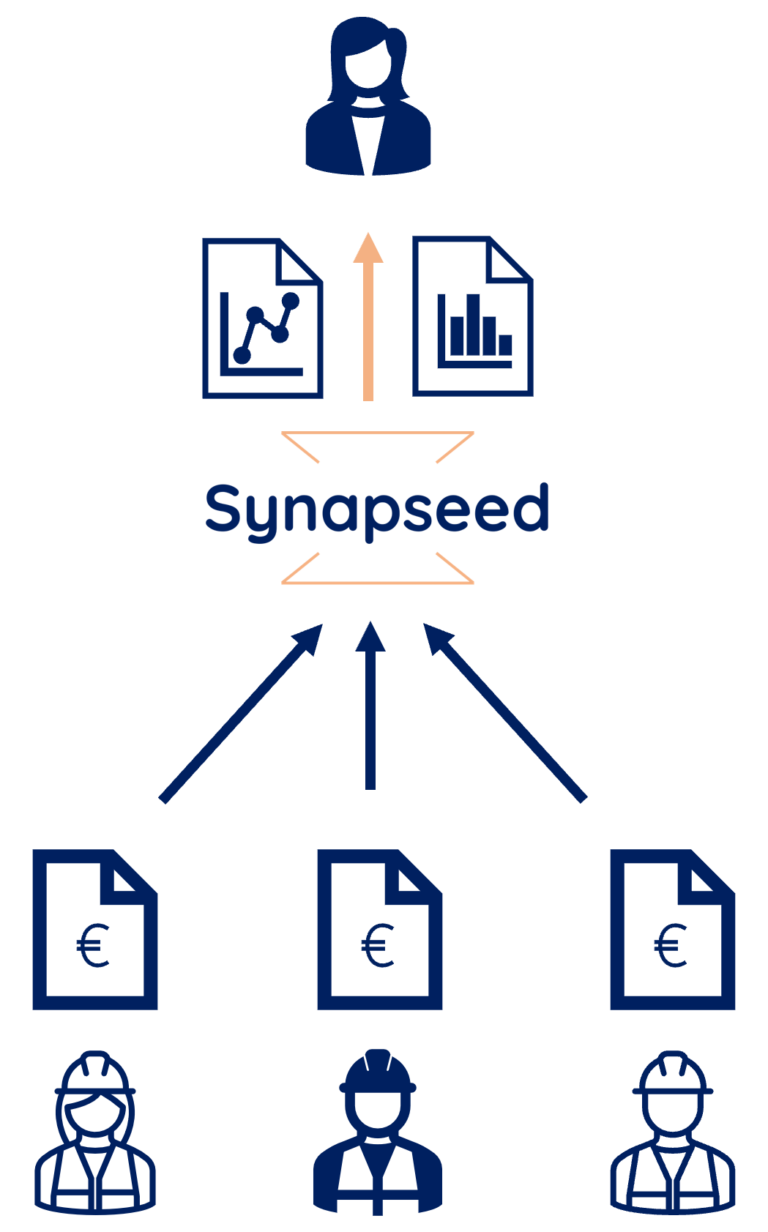

Project managers, working closely with project teams on-site, are in the best position to estimate future cash-flows. Their direct interaction with clients, suppliers, and subcontractors keeps them informed of potential timeline shifts and cost fluctuations, allowing for more accurate cash-flow projections.

However, they still rely on the accounting department’s input, such as detailed open payables and receivables specific to their construction sites. Regular communication between on-site teams and accounting is therefore crucial for ensuring the accuracy of cash-flow forecasts.

After individual site forecasts are created, another key challenge is to efficiently consolidate them to gain a company-wide perspective on future cash-flow requirements.

As short-term cash forecasts depend heavily on invoice data stored in accounting software, companies often seek to integrate cash forecasting tools directly within those systems for easier reporting. However, this integration can be challenging for larger companies with numerous subsidiaries, branches, or joint-ventures due to the variety of software used across these entities.

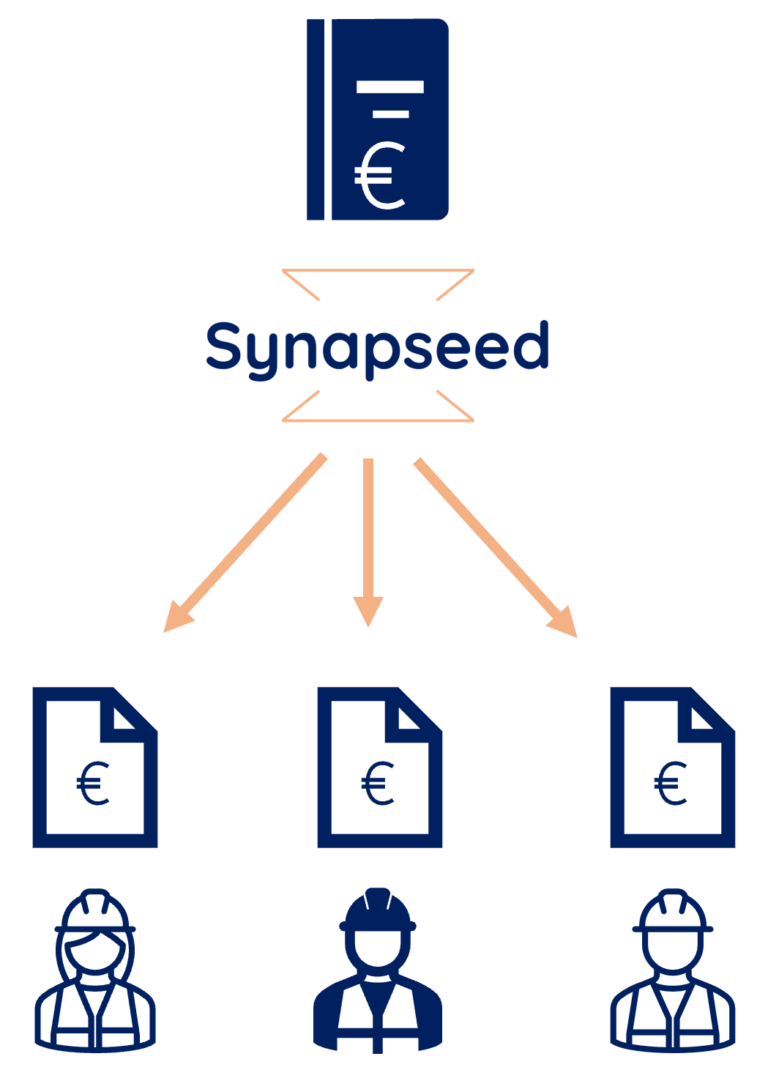

At Synapseed, we use custom built-solutions that allow us to efficiently

- Provide on-site teams with the accounting details they need, and

- Gather each cash-flow forecast per site to aggregate them into a single database for reporting purposes.

Step 1 :

- Extraction of open payables/receivables from accounting ledger

- Breakdown by site

- Dispatch to each Project Manager via a dedicated template

Step 2 :

- Collection of each Site template, filled by Project Managers

- Aggregation of data into a single database

- Reporting delivery to Decision Makers